2025 Retirement Contribution Limits Chart. For 2025, the irs has increased the contribution limit for 401 (k), 403 (b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2025. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

The ira contribution limits for 2025 are $6,500 for those under age 50 and $7,500 for those 50 and older. Effective january 1, 2025, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that the contribution may not exceed the lesser of 10% of compensation or $5,000 (indexed).

The employee contribution limit for 401 (k) plans in 2025 has increased to $23,000, up from $22,500 for 2025.

After Tax 401k Contribution Limits 2025 Hana Quinta, This year you will be able to save more for retirement than ever before with increased salary deferral contribution limits for employee retirement plans. Remember, the ira contribution limit and the 401 (k)/403 (b) contribution limit are separate.

Blog Page 8 Personal Finance Club, For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. The annual contribution limit for a traditional ira in 2025 was.

What’s the Maximum 401k Contribution Limit in 2025? (2025), This year you will be able to save more for retirement than ever before with increased salary deferral contribution limits for employee retirement plans. The basic limit on elective deferrals is $23,000 in 2025, $22,500 in 2025, $20,500 in 2025, $19,500 in 2025 and 2025, and $19,000 in 2019, or 100% of the.

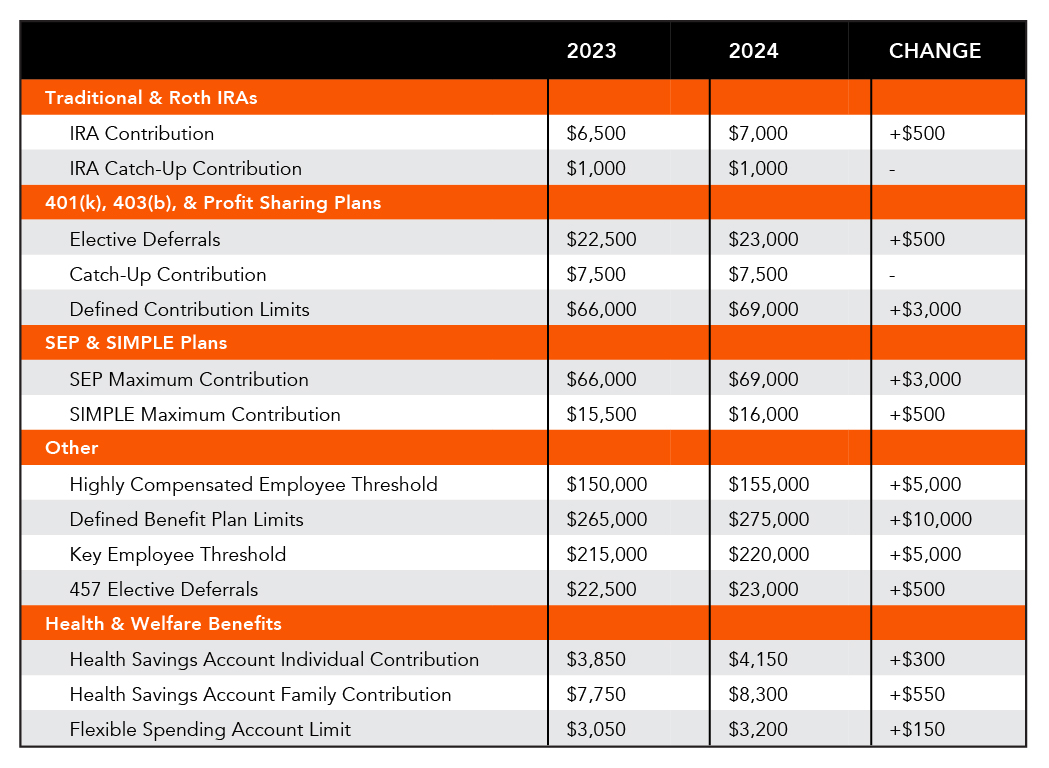

Plan Sponsor Update 2025 Retirement & Employee Benefit Plan Limits, Remember, the ira contribution limit and the 401 (k)/403 (b) contribution limit are separate. This amount is up modestly from 2025, when the individual 401.

2025 Contribution Limits for Retirement Plans — Sandbox Financial Partners, For 2025, the irs has increased the contribution limit for 401 (k), 403 (b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2025. You can contribute to both a 401 (k)/403 (b) and a traditional or roth.

IRS Announces 2025 Retirement Plan Limitations, Irs bumps 2025 401 (k) contribution limit to. Irs releases 2025 retirement plan limitations.

Significant HSA Contribution Limit Increase for 2025, The annual contribution limit for a traditional ira in 2025 was. This amount is up modestly from 2025, when the individual 401.

2025 Irs Limits For Retirement Plans Wally Jordanna, Roth ira contribution limits are set based on your modified gross adjusted income. 2025 contribution limits for retirement plans.

2025 Hsa Family Contribution Limits X2023D, 2025 sep ira contribution limits. The irs has increased the 401 (k) plan contribution limits for 2025, allowing employees to defer up to $23,000 into workplace plans, up from $22,500 in.

Annual Retirement Plan Contribution Limits For 2025 Social(K), Make a plan to save regularly. For 2025, the irs has increased the contribution limit for 401 (k), 403 (b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2025.

The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

The basic limit on elective deferrals is $23,000 in 2025, $22,500 in 2025, $20,500 in 2025, $19,500 in 2025 and 2025, and $19,000 in 2019, or 100% of the.